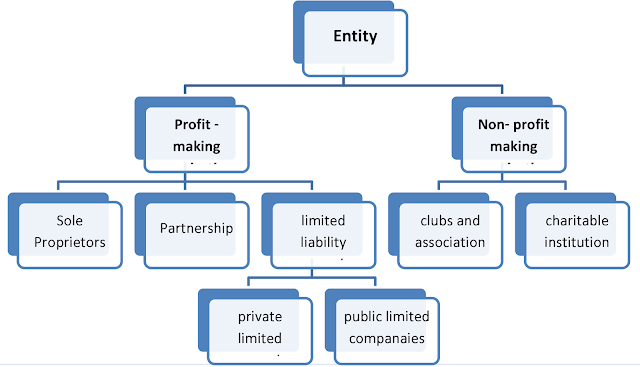

1.Entity: It is an economic unit that performs economic activities.

2.Event: it is the happening of a circumstance to an entity. An event is the recognition of an entry in accounting records.

3.Transaction: a transaction is an exchange in which each participant receives or sacrifices value. It involves exchange of goods or services on cash or credit basis. An event occurring involving transfer of money or money’s worth (only financial nature are considered) from one account to another account.

4.Voucher: it is a primary source document which serves as an evidence of a transaction and later on used as the base to record in the books of accounts

5.Entry: it is the record made in the accounts in respect of a transaction or an event. An entry is passed on the basis of voucher.

6.Assets: it refers to tangible objects or intangible rights of an enterprise from which future economic benefits are expected to flow to the enterprise. The assets can be classified as under:

a.Fixed assets: Non-current assets are held for the purpose of providing or producing goods or services and those that are not held for resale in the normal course of business.

i. Tangible Fixed Assets: refer to those fixed assets which can be

seen and touched. For e.g., Land & buildings, plant & machinery,

Furniture & Fixtures.

ii. Intangible Fixed Assets: refer to those fixed assets which cannot

be seen nor touched. For e.g., Goodwill, Patent, Trademarks, Copyrights, etc.

b.Current Assets: refer to those assets which are held as:

i. In the form of cash or cash equivalents

ii.For the purpose of trading i.e., for resale.

iii.It is expected to realise within twelve months

iv.For the consumption in the production of goods or rendering of services in the course of business.

For e.g., cash in hand, cash at bank, stock of finished goods, debtors, Bills Receivable, etc.

7.Debtor: A person who owes money to the firm mostly on account of credit sales of goods is called a debtor. For example, when goods are sold to a person on credit that person pays the price in future, he is called a debtor because he owes the amount to the firm.

8.Bills Receivables: it means the amount which is receivable by the firm other than debtors of the business.

9.Loans & Advances: an advance given to a supplier of an item of property.

10.Inventories (or Stock): it refers to tangible property held for sale in the ordinary course of business. It is held as :

a.Raw materials: regularly used in the production.

i.Components

ii.Stores

iìi.Spares

b.Semi-finished goods: also called as work in progress.

c.Finished good: final goods or goods produced.(manufacturing firm)

The stock may be opening stock or closing stock. Opening stock means the good lying unsold at the beginning of the current accounting period. Closing stock means the good lying unsold at the end of the current accounting period.

11.Liabilities: It means the amount which the firm owes to outsiders that is, except the proprietors. In simple terms, debts repayable to outsiders by the business are known as liabilities. It may be defined as the existing obligations which a business enterprise requires to meet sometime in future. Liabilities may be classified into three types namely:

a.Short-Term Liabilities

b.Long-Term Liabilities

c.Contingent Liabilities

a.Short-term Liabilities: are such obligations which are payable within one year. For eg: creditors, bills payable, overdraft etc.

b.Long- Term Liabilities: are such obligations which are payable after a period of more than one year such as debentures, bonds etc.

c.Contingent Liabilities: is a liability which arises only on the happening of an uncertain event. If it happens, the contingent liability is there.

12.Creditor: A person to whom money is being owed by the firm is called creditor. For example, M is a creditor of the firm when goods are purchased on credit from him.

13.Capital: It means the amount (in terms of money or assets having money value) which the proprietor has invested in the firm or can claim from the firm. It is also known as owner’s equity or net worth. Owner’s equity means owner’s claim against the assets.

Capital = Assets - Liabilities.

14.Goods: It is a general term used for the articles in which the business deals; ie, only those articles which are bought for resale for profit are known as Goods.

15.Revenue: It means the amount which, (as a result of operations,) is earned by a business by selling a product or rendering services to the customers is called revenue. It includes all incomes like sales receipts, interest, commission, brokerage etc. However, receipts of capital nature like additional capital, sale of assets etc., are not apart of revenue.

16.Expense: The terms ‘expense’ refers to the amount incurred in the process of earning revenue. If the benefit of an expenditure is limited to one year, it is treated as an expense (also know is as revenue expenditure) such as payment of salaries and rent.

17.Expenditure: are the costs incurred in acquiring an asset or service in the form of outflow or in the incurrence of a liability. Here cost is the measure of expenditure.

18.Income: is the increase in economic benefits during an accounting period in the form of

a)Inflow of assets, b) Decrease of liabilities.

It results in increase in internal equity other than those relating to contribution from equity participants. Equity participants means:

- Proprietor in case of sole Proprietorship

- Partners in case of Partnership firm

- Shareholders in case of a company.

19.Purchases: Buying of goods by the trader for selling them to his customers is known as purchases. As the trade is buying and selling of commodities purchase is the main function of a trade. Here, the trader gets possession of the goods which are not for own use but for resale.

Purchases can be of two types. Viz., cash purchases and credit purchases. If cash is paid immediately for the purchase, it is cash purchases. If the payment is postponed, it is credit purchases.

20.Sales: When the goods purchased are sold out, it is known as sales. Here, the possession and the ownership right over the goods are transferred to the buyer. It is known as' Business Turnover’ or ‘Sales proceeds’. It can be of two types, cash sales and credit sales. If the sale is for immediate cash payment, it is cash sales. If payment for sales is postponed, it is credit sales.

21.Stock: The goods purchased are for selling, if the goods are not sold out fully, a part of the total goods purchased is kept with the trader unlit it is sold out, it is said to be a stock. If there is stock at the end of the accounting year, it is said to be a closing stock. This closing stock at the yearend will be the opening stock for the subsequent year.

22.Drawings: It is the amount of money or the value of goods which the proprietor takes for his domestic or personal use. It is usually subtracted from capital.

23.Losses: Loss really means something against which the firm receives no benefit. It represents money given up without any return. It may be noted that expense leads to revenue but losses do not. (e.g.) loss due to fire, theft and damages payable to others.

24.Account: It is a statement of the various dealings which occur between a customer and the firm. It can also be expressed as a clear and concise record of the transaction relating to a person or a firm or a property (or assets) or a liability or an expense or an income.

25.Invoice: While making a sale, the seller prepares a statement giving the particulars such as the quantity, price per unit, the total amount payable, any deductions made and shows the net amount payable by the buyer. Such a statement is called an invoice.

26.Voucher: A voucher is a written document in support of a transaction. It is a proof that a particular transaction has taken place for the value stated in the voucher. Voucher is necessary to audit the accounts.

27.Proprietor: The person who makes the investment and bears all the risks connected with the business is known as proprietor.

28.Discount: When customers are allowed any type of deduction in the prices of goods by the businessman that is called discount.

When some discount is allowed in prices of goods on the basis of sales of the number of items(quantity), that is termed as trade discount, but when debtors are allowed some discount in prices of the goods for quick payment, that is termed as cash discount.

29.Solvent: A person who has assets with realizable values which exceeds his liabilities is solvent. i.e., assets>liabilities.

30.Insolvent: A person whose liabilities are more than the realizable values of his assets is called an insolvent. i.e., assets<liabilities.

31.Net profit: means the excess of revenue over expenses.

32.Net loss: means the excess of expenses and losses over revenue.

33.Accruals: is a liability to pay for goods and services that are received, but for which the price stands unpaid at the end of the accounting or reporting period. It is often referred to as, Outstanding liability.

34.Provisions: is a liability of uncertain timing or amount and is usually based on estimations. They are of two types:

i.Provision for a liability

ii.Provision for the reduction in the value of assets.

i. Provision for a liability: is an estimate made for a probable liability. It is shown as a separate item under current liabilities. For e.g., provision for income tax, provision for penalty.

ii.Provision for the reduction in the value of assets:are shown in the balance sheet as a deduction from the respective assets. For e.g., provision for doubtful debts.